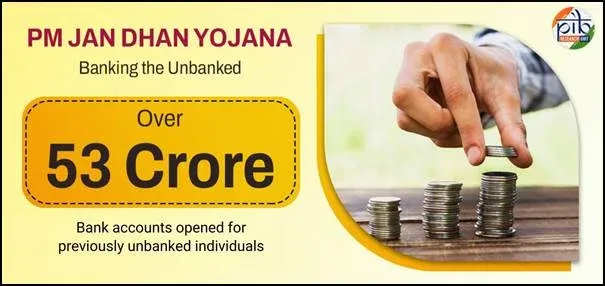

India Achieves Milestone with 530 Million Bank Accounts Opened

The Indian government has announced a significant achievement in its financial inclusion efforts, surpassing 530 million bank accounts opened nationwide. This initiative marks a major step towards bringing banking services to a larger segment of the population, particularly in rural and underserved areas.

This milestone reflects the success of various government schemes aimed at promoting financial literacy and accessibility. These schemes have incentivized banks to expand their reach and offer simplified banking services to individuals who were previously excluded from the formal financial system.

The increase in bank account ownership is expected to have a positive impact on the Indian economy. It facilitates direct benefit transfers, reduces leakage of funds, and empowers individuals to save and invest more effectively. Furthermore, it promotes transparency and accountability in financial transactions.

Key benefits of increased financial inclusion include:

- Direct Benefit Transfers: Efficient and transparent transfer of government subsidies and benefits.

- Reduced Corruption: Minimizing the scope for corruption and fraud in welfare programs.

- Economic Empowerment: Enabling individuals to manage their finances and participate in the formal economy.

- Increased Savings and Investment: Encouraging savings habits and promoting investment opportunities.

The government is committed to further strengthening the financial inclusion ecosystem by leveraging technology and expanding the network of banking correspondents. This will ensure that banking services are accessible to all, regardless of their location or socio-economic background.

The opening of 530 million bank accounts is not just a numerical achievement, but a reflection of the government’s commitment to empowering its citizens and building a more inclusive and equitable society. This initiative has the potential to transform the lives of millions of people and contribute to the overall economic development of the nation.

Future initiatives are expected to focus on enhancing digital literacy and promoting the use of digital payment platforms. This will further empower individuals to manage their finances and participate in the digital economy.

The success of this initiative is a testament to the collaborative efforts of the government, banks, and other stakeholders who are working together to promote financial inclusion and empower the citizens of India.

Disclaimer: This news article is based on publicly available information and may be subject to updates.

📢 Stay Updated!

For more news and updates, explore related categories below: